The cold had settled hard over Winnipeg that week—the kind of cold that sneaks through window frames and makes even the warmest homes feel brittle. Maria, a cashier at a local grocery store, sat at her kitchen table early on a Monday morning, still bundled in her coat. Her breath made faint clouds in the air as she read the bright red words on a notice from her utility company: FINAL WARNING.

She wasn’t reckless with money; she simply didn’t earn enough to stretch her paycheques across months filled with unpredictable expenses. A cut in her hours meant her income dropped just when the heating bill jumped. With payday still six days away, the math didn’t add up. What she needed wasn’t a big loan — just enough to keep the heat on so her kids wouldn’t wake up shivering.

That’s when she turned to the internet and typed in words millions of Canadians search every year:

“No refusal payday loans Canada.”

The ads promised instant approval, money in minutes, no credit check, and 24/7 access. It seemed like a solution: quick, simple, and free of judgment. She got the money within the hour. But weeks later, the fees hit her like a second storm she hadn’t seen coming.

Maria’s experience isn’t unusual. In fact, it’s one of the most common stories behind no-refusal payday loans. And if you’re asking yourself, “What fees and interest rates do these loans actually come with?”, you’re already a step ahead of many borrowers.

So let’s break it down clearly, simply, and with the facts in plain view.

What Exactly Are No-Refusal Payday Loans in Canada?

“No-refusal” is less a legal term than a marketing promise. It tells borrowers: Even if banks say no, we won’t.

These lenders usually require only:

- A bank account

- Government-issued ID

- Proof of regular income

No deep credit checks. No long applications. No waiting.

It feels like a lifeline — and for some, it is.

But behind that convenience is a cost structure that’s tightly regulated across Canada yet often misunderstood by borrowers. These loans are among the most expensive types of credit in the country, and understanding that cost is the safest way to use them responsibly.

What Do No Refusal Payday Loans Typically Cost?

Most payday loans have a set fee for every $100 you borrow. Each province decides its own legal maximum for these fees.

Below are the maximum fees lenders are allowed to charge for each $100 — and these apply just the same to “no refusal” loans.

💲 Maximum Cost Per $100 Borrowed (Government of Canada, 2024)

- Ontario: $15

- British Columbia: $15

- Alberta: $15

- New Brunswick: $15

- Manitoba: $17

- Nova Scotia: $17

- Saskatchewan: $17

- Newfoundland & Labrador: $14

- Prince Edward Island: No regulated cap, but lenders follow similar ranges

- Quebec: Effectively bans payday loans by capping interest at 35% APR

Financial Consumer Agency of Canada (FCAC), Payday Loan Regulations, 2024

📌 Let’s Put Those Numbers Into Real Life

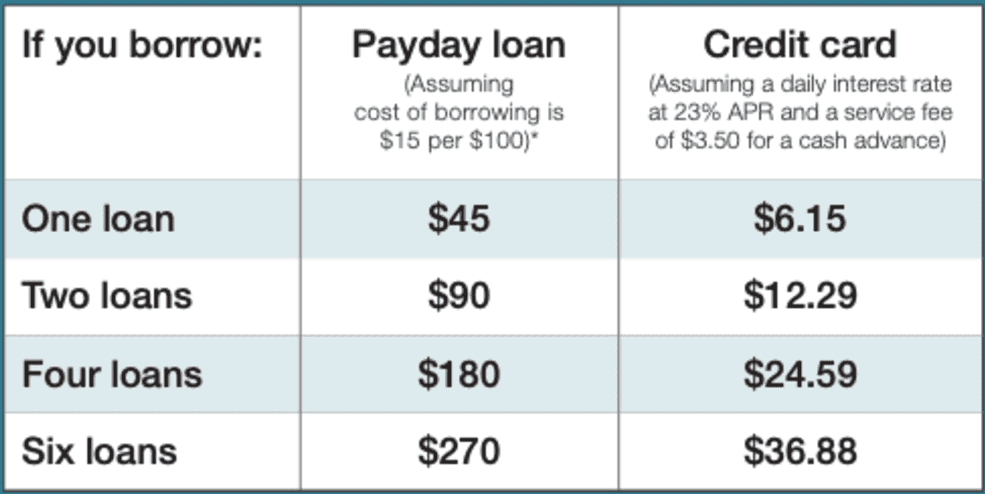

Say Maria borrowed $300 in Ontario, where the maximum cost is $15 per $100.

- $300 × $15% = $45 fee

- Total repayment due on next payday = $345

It doesn’t sound awful at first glance — until you realise how short the repayment window is and how quickly that fee adds pressure to your next paycheque.

⚠️ The APR: The Number That Shocks Most Canadians

Payday lenders rarely mention APR, but it’s the truest measure of how expensive these loans are. Because payday loans are repaid within 14 days, their annualised cost is enormous.

According to FCAC:

- A $100 loan costing $15 over 14 days = 391% APR.

- A $100 loan costing $17 over 14 days = 443% APR.

Source: FCAC, 2024

These are not typos — these rates are over four hundred percent. This is why no refusal payday loans must be considered short-term emergencies only, never long-term financial tools.

🧾 Other Fees Canadians Don’t Always Expect

The initial fee is just one piece. Borrowers may also face:

1. NSF Fees

If the lender pulls funds and there’s not enough money in your account:

- Bank NSF fee: around $45

- Lender NSF fee: up to $50

That’s almost $100 gone instantly — and your original loan still isn’t paid.

2. Late Payment Fees

Even though most provinces ban rollovers, lenders can still charge:

- Late fees

- Additional interest

- Collection costs

These can turn a $300 loan into a $450 repayment shockingly fast.

3. Brokerage Fees

Some “no refusal” lenders use third-party brokers who add:

- $20 to $100 to the cost of borrowing

These fees often surprise borrowers during the final step of the application.

Why Are No Refusal Payday Loans So Expensive?

Because lenders approve nearly everyone — including those with:

- poor credit,

- unstable income,

- previous defaults,

- high debt loads,

—they price in significant risk. Economists call this risk-based pricing. When lenders don’t filter applicants by creditworthiness, they compensate with higher fees.

This doesn’t make the lenders villains. It simply means these products are designed for short-term, high-risk lending, and that comes with high costs.

How Costs Differ Across Canadian Provinces

Ontario, BC, Alberta, New Brunswick

- Cost: $15 per $100

- Highly competitive markets with strict consumer rules

Manitoba, Nova Scotia, Saskatchewan

- Highest capped rate: $17 per $100

Newfoundland & Labrador

- Lowest: $14 per $100

Quebec

- Interest capped at 35% APR

- Payday lenders cannot operate profitably, so the industry is essentially absent.

These differences mean two Canadians borrowing the exact same amount can pay very different fees based solely on where they live.

How Flex Inest Helps Canadians Borrow Smarter

If you’re considering no refusal payday loans in Canada, Flex Inest provides clear, transparent information to help you compare costs and understand exactly what you’re agreeing to. The goal is simple: helping Canadians make smart borrowing decisions while avoiding unnecessary financial stress.

Flex Inest also shares practical alternatives and tools so borrowers aren’t left navigating complicated loan terms alone.

Tips Before Taking a No Refusal Payday Loans

✔ Compare lenders — some hide extra fees in the fine print

✔ Check your province’s maximum rates

✔ Avoid brokers if possible

✔ Borrow the minimum needed, not the maximum offered

✔ Look into alternatives such as overdraft protection, employer advances, credit union small-dollar loans, or instalment loans with lower APRs

No refusal payday loans offer speed, convenience, and near-guaranteed approval — but those benefits come at a high price. With fees ranging from $14 to $17 per $100, additional NSF and late charges, and effective APRs soaring above 300%, borrowers must approach these loans with caution and a clear understanding of the full cost.

Knowing the numbers, comparing your options, and planning your repayment can help you use these loans safely — or avoid them altogether if better alternatives exist.

Frequently Asked Questions

Sharron Gaines is a freelance financial writer for Flexinest. With over a decade of experience in personal finance and lending, she’s passionate about helping Canadians make smart money decisions. From understanding payday loans and credit options to managing budgets and improving financial health, Sharron’s goal is to simplify complex financial topics for everyday readers.

When she’s not writing about money matters, Sharron enjoys exploring local cafés, reading about financial trends, and spending time outdoors with her family.