When unexpected expenses pop up, it’s natural to look for quick solutions. But not all loans are created equal. If you’re trying to decide between an installment loan and a payday loan, understanding the difference could save you a lot of money—and stress.

Let’s break it down in simple terms.

What is a Payday Loan?

A payday loan is a short-term, high-interest loan designed to be paid back in full on your next payday. It usually covers small amounts, often under $1,500.

How it works:

- You borrow money quickly, sometimes within hours.

- The full loan amount, plus fees and interest, is due on your next paycheck.

- If you can’t pay it all back at once, you may have to extend the loan—or worse, take another one.

The problem:

Because everything is due at once, many borrowers get stuck in a cycle of debt, paying more in fees than they originally borrowed.

What is an Installment Loan?

An installment loan is a personal loan you repay over time through scheduled payments—weekly, biweekly, or monthly. It’s usually for slightly larger amounts ($300 to $5,000).

How it works:

- You borrow a set amount.

- You agree on a repayment plan over weeks or months.

- Each payment covers part of the loan and interest, making it easier to budget.

The benefit:

Installment loans are designed to be manageable, giving you breathing room instead of financial panic.

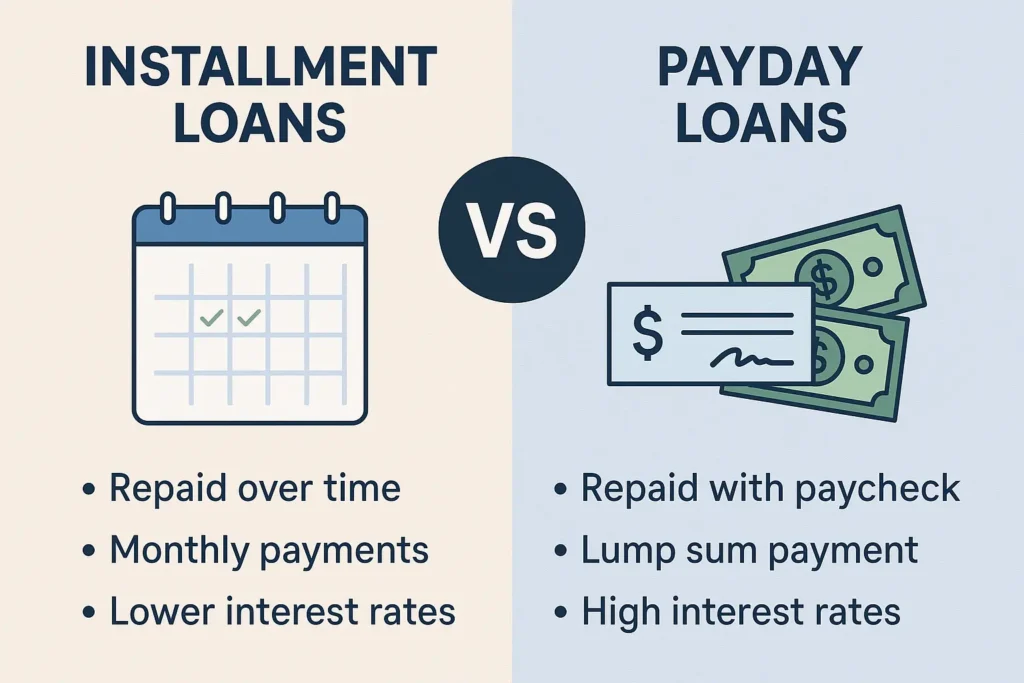

Quick Comparison: Installment Loan vs Payday Loan

| Feature | Installment Loan | Payday Loan |

|---|---|---|

| Repayment Style | Spread out over time | Paid in one lump sum |

| Loan Amount | $300 – $5,000 | $100 – $1,500 |

| Interest Rate | Lower (still varies) | Very high |

| Credit Check | Flexible options | Often no real check |

| Best for | Managing over time | Very short-term emergency |

| Risk | Lower | High (cycle of debt risk) |

Why Installment Loans Are a Safer Choice

✔ Predictable payments: You know exactly what you owe and when.

✔ Lower chance of rollover: No need to borrow again because you can’t pay it all back at once.

✔ Helps build credit: Making regular payments can actually improve your credit score.

✔ More affordable: Even if the APR seems high, the real cost is often much lower than a payday loan.

At Flexinest, we focus on installment loans because we believe borrowing should help you, not trap you.

Final Thoughts

If you need a little extra help, installment loans offer a more manageable, responsible path forward. Payday loans might seem fast and easy, but they often come with hidden risks that aren’t worth the short-term relief.

Ready to explore smarter borrowing? Apply now for a flexible installment loan with Flexinest.