If you’ve been searching for a flexible way to borrow money, you’ve probably come across the term installment loan. But how do installment loans actually work in Canada—and are they the right fit for your needs?

At Flexinest, we believe in keeping things simple. Here’s everything you need to know, without the confusing financial jargon.

What Exactly Is an Installment Loan?

An installment loan is a personal loan that you repay over time through regular, fixed payments—called installments. Instead of paying everything back at once, you spread the cost out, making it easier to manage your budget.

Example:

Let’s say you borrow $1,000. Instead of paying it all back in two weeks (like a payday loan), you could spread it over 6 months, making smaller payments every two weeks or every month.

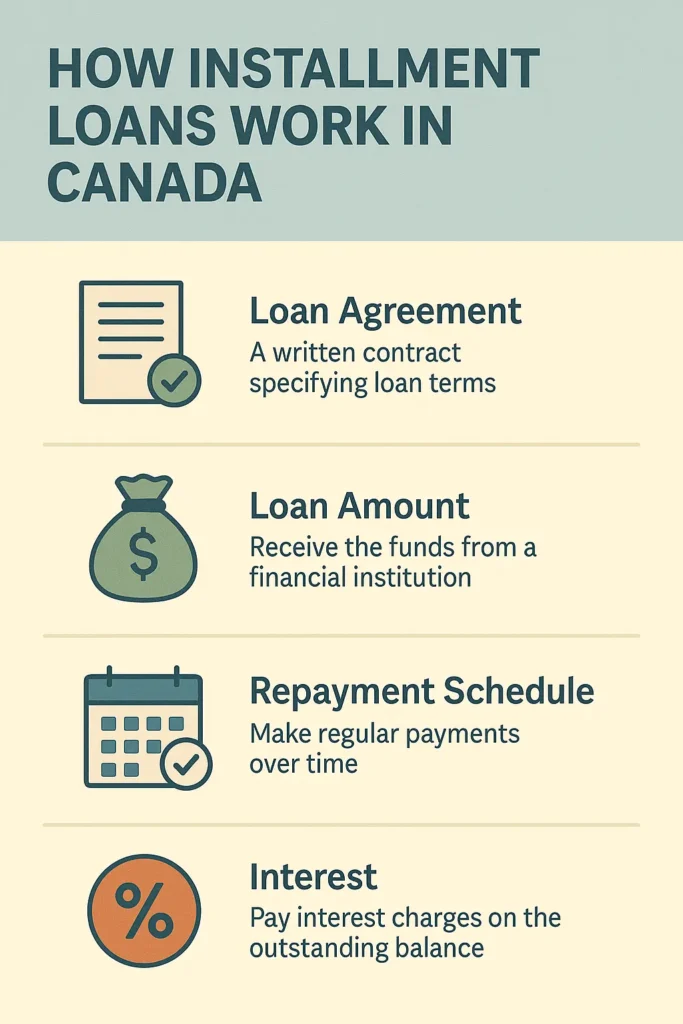

How Do Installment Loans Work in Canada?

Repay Over Time: Make your scheduled payments until the loan is fully repaid. Many borrowers choose automatic withdrawals to make it easy.

Apply Online: Start by filling out a short application. (With Flexinest, it only takes a few minutes.)

Get Approved: Lenders look at factors like your income, employment status, and sometimes your credit history. Good news—you don’t need perfect credit to qualify.

Review the Loan Offer: You’ll see exactly how much you’ll borrow, how much each payment will be, and the total cost of the loan.

Receive Your Funds: Once you accept the offer, the money is usually deposited straight into your bank account—sometimes the same day.

What Are the Benefits of Installment Loans?

✔ Manageable Payments: Break the loan down into smaller, affordable chunks.

✔ Predictability: Fixed payments help you plan your budget.

✔ Speed: Fast approvals mean you get your money quickly.

✔ Flexible Terms: Choose a repayment plan that fits your lifestyle—weekly, biweekly, or monthly.

✔ Support for All Credit Types: Many lenders work with borrowers who have less-than-perfect credit.

How Are Interest Rates Calculated?

In Canada, short-term loans often show a high Annual Percentage Rate (APR) because they are meant to be repaid quickly.

Don’t be alarmed by a high APR—it reflects what the cost would be over an entire year, not the short period you’re borrowing for.

Always look at the actual payment amount and the total loan cost, not just the APR.

Things to Watch Out For

While installment loans are safer than payday loans, you should still:

- Read the terms carefully: Know your payment schedule and fees.

- Borrow only what you need: It’s tempting to take more, but borrowing wisely keeps repayment stress low.

- Reach out if you need help: If you think you might miss a payment, talk to your lender early.

At Flexinest, we believe borrowing should be a tool to move forward—not a trap.

Final Word: Installment Loans Make Borrowing Easier

If you need quick cash but want a responsible way to pay it back, an installment loan might be the perfect solution.

With flexible terms, fair rates, and real customer support, Flexinest is here to help Canadians borrow smarter—not harder.

Ready to get started? Apply online now and find the right installment loan for your needs.